Federal Solar Incentives Change in 2026. Claim Your Savings Now.

Start Your Solar Project Today!Solar Tax Credits Are Ending:

Act Now to Save

On July 4, 2025, the One Big Beautiful Bill (H.R. 1) became law. It immediately changed how tax credits for solar work, cutting off key incentives for homeowners after this year and making it harder for businesses to qualify in the future. The message is clear: waiting will cost you.

What You Need to Know

Residential Tax Credits End in 2025

- 9By December 31, 2025.

- 9After this, the 30% solar tax credit for homeowners (Section 25D) goes away entirely.

Commercial Projects

Commercial projects in 2026 and beyond remain eligible for the 48E Investment Tax Credit (ITC), which is at least 30% of your project cost as long as they comply with a few extra rules regarding the materials sourced for the project.

>> Non FEOC (Foreign Entities of Concern) materials need to be used for increasing percentages, based on the year of purchase.

>> Sourcing domestic products for your solar array will earn you an extra 10% ITC.

>> Projects that are low income, or located in a Energy Community could also earn you extra ITC %s.

New Projects with contracts in 2026:

Must be sourced with materials from Non-FEOC Countries (foreign entities of concern)

Construction must “begin”, or safe harbor before July 4th, 2026 to be given until 2030 to finish.

If booking after July 4th, the project must be placed in service by Dec 31, 2027.

Domestic material percentages and non- FEOC material percentages increase each year from 2026-2030.

2025 Safe Harbored Projects:

Contracts, planning and expenditures started in 2025.

Safe Harbor rules allow you to start now and finish later, while still preserving incentives.

These projects have until 2030 to be completed.

Domestic content material percentages and Non-FEOC material percentages remain frozen at the time of the safe harbor.

Power Bills Are Going Up

- 9In 2025, businesses can claim 100% bonus depreciation on solar investments. This is a major financial advantage.

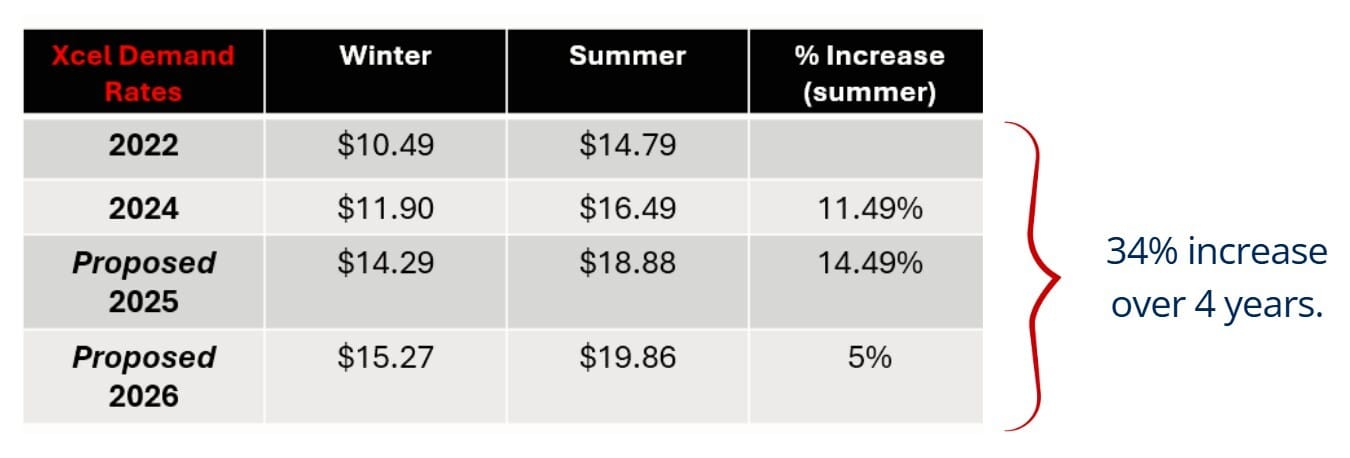

- 9 Since 2022, utility rates have been climbing faster than inflation. With rising energy demands and stalled infrastructure projects, even sharper increases are on the horizon.

- 9When energy infrastructure projects are canceled, the strain on the grid increases.

- 9Solar is your best way to combat utility hikes.

New Restrictions in 2026

- 9Starting next year, projects must prove 40% of equipment is sourced from approved (non-FEOC) suppliers.

- 9Questions still exist on the qualification requirements of materials. Vetting the supply chain will involve cooperation with manufacturers and careful review of a heavily regulated landscape.

- 9These requirements will force pricing up and severely narrow the supply chain.

Why Act Now?

If you delay, you risk losing:

- 9 The 30% federal tax credit

- 9 Safe Harbor protection

- 9 Your chance to offset rising utility costs

- 9Access to bonus depreciation

Your Next Step

Contact Cedar Creek Energy Today to protect your project and maximize your savings. We’ll help you take advantage of Safe Harbor and navigate this rapidly changing policy landscape.